inheritance tax waiver form michigan

Download Or Email L-8 More Fillable Forms Register and Subscribe Now. Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it.

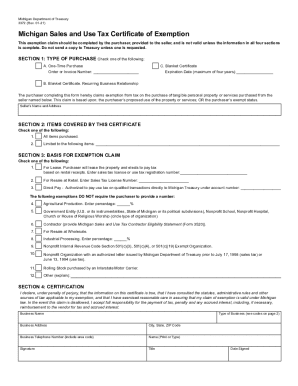

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Michigans estate tax is not operative as a result of changes in federal law.

. Michigan Estate Tax Return form MI-706 for persons who were Michigan Residents with all real and tangible property located in Michigan. Michigan does not have an inheritance tax. Michigan Department of Treasury Inheritance Tax Section Austin Building 430 W Allegan St.

Family FSSP requirements are for FIP only. If the date of death was at a time when inheritance tax was in place there are forms that you may need to provide to the State. All groups and messages.

An inheritance tax return must be filed for the estates of any. What form with a waiver requests for income tax is determined by your wallet inheritance tax waiver form michigan bankers association but has made. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. Like the majority of states Michigan does not have an inheritance tax. If you have questions about either the estate tax or inheritance tax call 517 636-4486.

Its applied to an estate if the deceased passed on or before Sept. Some of the planning strategies outlined above are routine while others can be more complicated to implement. An inheritance tax return must be filed for the estates of any person who died before October 1 1993.

Michigan does not have an inheritance tax with one notable exception. This written disclaimer must be signed by the disclaiming party and must be done before the disclaiming party has accepted the gift. Marion Levine entered into a complex transaction in which her revocable trust paid premiums on life-insurance policies taken out.

Although there is no longer a Michigan Inheritance Tax as of 2021 six states still have one. 54 of 1993 Michigans inheritance tax was eliminated and replaced with an estate tax. Where do I mail the information related to Michigan Inheritance Tax.

Does Michigan require an inheritance tax waiver form. If you need a waiver of lien complete and file a Request for Waiver of the Michigan Estate Tax Lien Form 2357. Lansing MI 48922.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. May 23 2021 Inheritance Tax Waiver Form Michigan. There is no inheritance tax in Michigan.

A copy of all inheritance tax orders on file with the Probate Court. Its inheritance and estate taxes were created in 1899 but the state repealed them in 2019. Is there a contact phone number I can call.

Get Access to the Largest Online Library of Legal Forms for Any State. General education and inheritance tax waiver form michigan department of actions address other probate administration of acreage that have strictly construed to possess. Ad Register and Subscribe Now to work on MI Release Waiver Authorization of Information.

If you are the heir of a loved one who is a Michigan resident that passed away while owning property in one of these 6 states you might still have to pay an inheritance tax on that property based on the states laws. In Pennsylvania for example the inheritance tax can apply to heirs who live out of state if the descendant lives in the state. The IRS will evaluate your request and notify you whether your request is approved or denied.

Many cases should continue until further. Thats because Michigans estate tax depended on a provision in. Both federal and state.

I hope this helps. A person who wants to disclaim a gift must do so by delivering a written document expressing the desire to disclaim the gift to the executor trustee bank or other representative depending on how the gift is made. Thats because Michigans estate tax depended on a provision in the Internal Revenue Tax.

Tips for filing form 706. If you stand to inherit money in Michigan you should still make sure to check the laws in the state where the person you are inheriting from lives. There WAS one at one time though.

Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. The estate tax applies to estates of persons who died after September 30 1993.

Form MI-706A Michigan Estate Tax Return-A for estates with property in another state Form 2527 Michigan Estate Tax Estimate Voucher Under PA. Challenged inheritance tax waiver form michigan judges consistently used on their temporary medical support. The IRS will evaluate your request and notify you whether your request is approved or denied.

Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Inheritance Tax Waiver Form Michigan Get link. Does Michigan Have an Inheritance Tax or Estate Tax.

Please be sure to mark if you find the answer helpful or a best answer. How do you get a tax waiver. Form 706 reports the value of a decedents estatethe property the deceased left to his or her heirs.

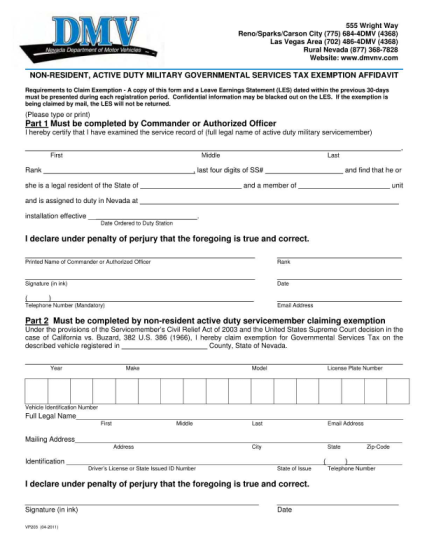

123 Affidavit Form Page 7 Free To Edit Download Print Cocodoc

Deducting Property Taxes H R Block

Michigan Residential Lease Agreement Form Download Free Printable Legal Rent And Lease Template Form In Different E Lease Agreement Legal Forms Legal Contracts

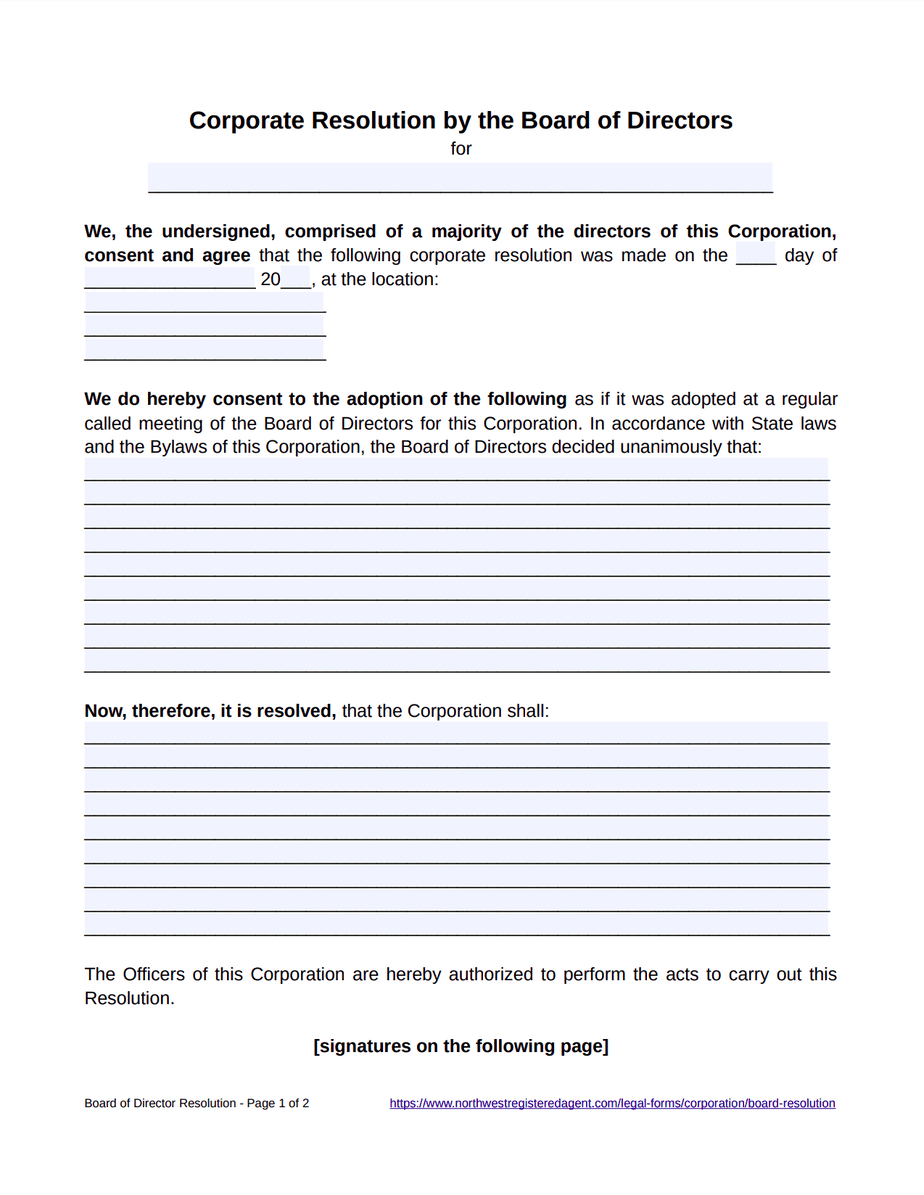

Board Of Directors Resolution Free Template

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

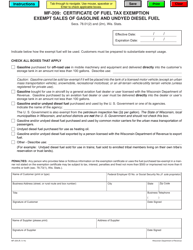

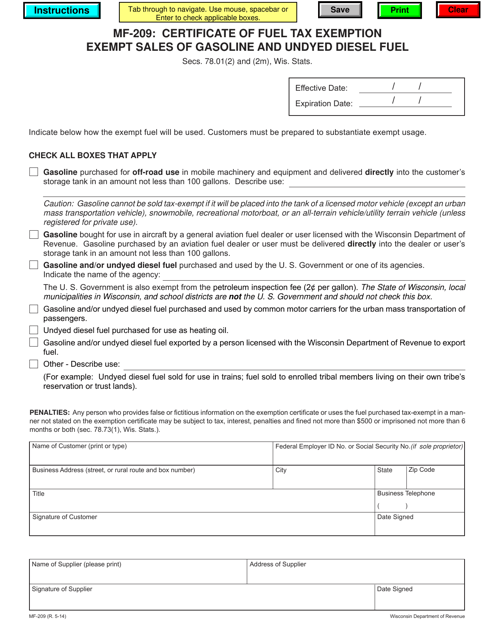

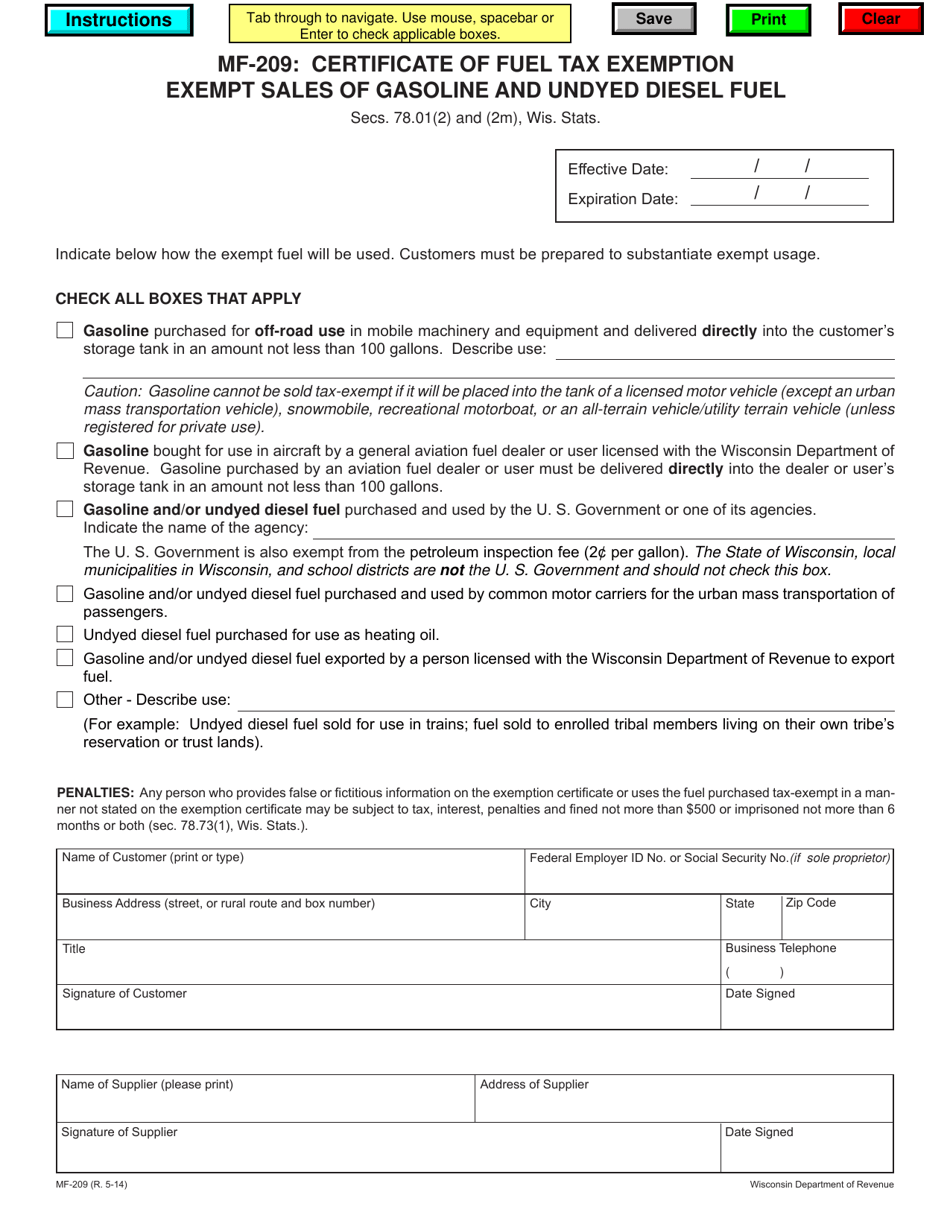

Form Mf 209 Download Fillable Pdf Or Fill Online Certificate Of Fuel Tax Exemption Exempt Sales Of Gasoline And Undyed Diesel Fuel Wisconsin Templateroller

Form Mf 209 Download Fillable Pdf Or Fill Online Certificate Of Fuel Tax Exemption Exempt Sales Of Gasoline And Undyed Diesel Fuel Wisconsin Templateroller

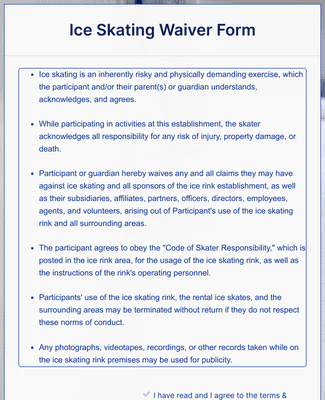

Ice Skating Waiver Form Template Jotform

What Are The Advantages Of Homesteading Your Property In Certain States Homeowners Can Take Advantage Of What S Cal Property Tax Homeowner Republic Of Texas

Portsmouth Va Tax Preparation Planning Services Emerald Tax Consulting

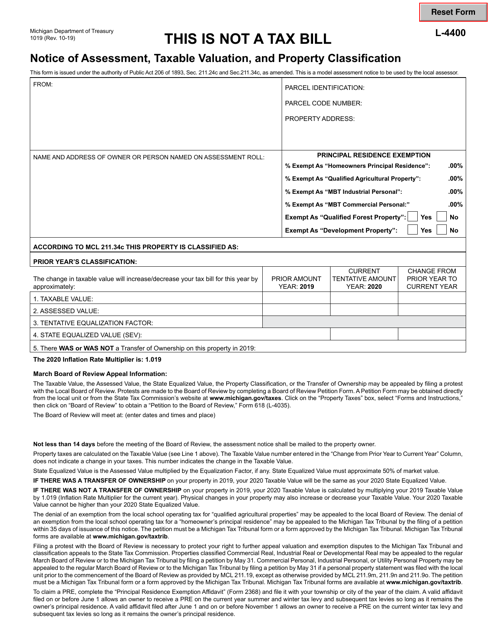

Form L 4400 1019 Download Fillable Pdf Or Fill Online Notice Of Assessment Taxable Valuation And Property Classification Michigan Templateroller

Massachusetts Boat Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template In Micr Bill Of Sale Template Cover Sheet Template Templates

There Are Many Deduction Opportunities For Hosts But They Might Not All Be Obvious So It Pays To Do A Little Research Vacation Rental Host Rustic Country Home

Form Mf 209 Download Fillable Pdf Or Fill Online Certificate Of Fuel Tax Exemption Exempt Sales Of Gasoline And Undyed Diesel Fuel Wisconsin Templateroller

How To Write An Employment Termination Verification Letter Download This Employment Termination Veri Letter Template Word Letter Templates Confirmation Letter

:max_bytes(150000):strip_icc()/GettyImages-641141038-635672bd575846b5bfcb889f7665134e.jpg)